Customer Lifetime Value

13 April 2020- 16 min read

13 April 2020- 16 min read

Customer Lifetime Value, or CLTV, can be used either for real-time analysis or as a prediction model for your business. By using CLTV, you can calculate what customers are worth to your business, both individually and collectively.

This can then be used either as a single metric or in conjunction with others to map out future strategies to help increase CLTV, reduce churn, and grow your business revenue and profit.

Customer lifetime value, or CLTV, is the amount of revenue you can predict a customer will generate when they subscribe to or buy, your product or service.

For example, if you sell your SaaS platform at a subscription cost of $39.99 per month, and the customer signs up for six months before unsubscribing, their individual CLTV will be $39.99 x 6 months, equaling $239.94.

When you add this up for all your customers and calculate the average, what you’re left with is the average CLTV in relation to your product or service.

Let’s say that your business mirrors the example we have above. This would mean that every time a new customer takes out a subscription, you assume they’ll spend at least $239.94 with you.

You can use CLTV for several purposes:

Focusing on CLTV instead of basic sales can help you to shift your analysis and your perspective towards building long-term relationships and managing your customers effectively.

Your sales team might be great at getting delivering sales that bring in $500 each time for your business. If those $500 customers never buy from you again, would it not be better to make $100 sales that repeat over an extended period?

When you factor in other metrics such as cost per customer acquisition, it’s likely to be more profitable for you to retain customers than always being focused on acquiring new ones.

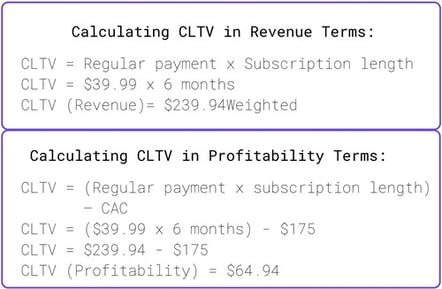

Calculating CLTV is simple to do. We’ve provided two calculations below so that you can calculate your “real terms” CLTV by factoring in the customer acquisition cost (CAC). Remember that you can calculate this on either a “per customer” basis or, as is more common for bigger picture analysis, across your business.

Use the below customer lifetime value formula to get your calculation.

As we can see from the customer lifetime value calculations, working out your CLTV in profitability terms is a far more favorable outcome. Doing will give you a greater insight into your wider business processes and might show you that you need to focus on reducing CAC as well as on building your customer relationships.

Your CLTV calculation should only be a starting point for improving and growing your business, and not the result!

Use Upodi’s customer lifetime value calculator at the top of the page to discover your business’ CLTV!

To help you further understand how to calculate CLTV, we’ve put it into a real-world example.

An Amazon Prime membership costs $12.99 in the United States. While Amazon has not made available any data that gives the average length of a subscriber tenure – why would they, when such data would be valuable to Netflix and other competitors? – it has been widely reported that over half of United States households are subscribers, which is a colossal number.

Let’s say that the average subscriber who pays for Amazon Prime every month subscribes for 65 months.

That would mean that Amazon would calculate their CLTV as below. We have no way of knowing Amazon’s CAC – this would be a complex calculation as it’s likely many subscribers previously bought something from Amazon and could have reached the site via multiple channels – so we’ll calculate this based on revenue only.

$12.99 per month x 65 months = $844.35

Of course, Amazon would factor additional numbers into that. For example, it is reported that Prime subscribers spend an average of $1,400 a year shopping on Amazon, so some of this would potentially factor into the CLTV if Amazon felt that Prime benefits, such as free next-day delivery, helped to drive purchasing decisions.

CLTV is an important metric as it can help you to focus your resources more effectively within your business. As we explored earlier, it is likely to be more effective and profitable for your business to focus on maximizing value for and from your existing customers than it is to continually be acquiring new ones.

Focusing on CLTV is to focus on a long-term vision and growth for your business. By aiming to increase your CLTV, you must focus on improving your customer relationships from the moment you acquire them. Such focus could help your business to improve everything from sales conversations and client onboarding to ongoing service and how you manage the discussion when customers call you to cancel.

When you’re selling SaaS with a subscription model, a higher CLTV means your customers are staying with you for longer.

Focus on CLTV for business growth to ensure you earn recurring sales and continue to build your customer base.

There are three main ways you can increase your CLTV.

Find out more about the author and follow them and social media to stay connected with them

/Originals/Rasmus.jpg)

Rasmus Foged is the CEO at Upodi. Further he is an experienced entrepreneur, starter, manager, and leader. He is driven by his passion of making Upodi the #1 European subscription management SaaS solution. He takes pride in having the best team possible and encouraging the team is a high priority. Outside of the office, Rasmus enjoys movies and especially movie themes (big fan of Hans Zimmer).

Check out our related posts based on your search that you may like